Steady as she goes in the Spring Statement

Dr Martin Turner, BIA Policy and Projects Manager, takes a look at today's Spring Statement from Chancellor Phillip Hammond and its implications for the bioscience sector.

The Chancellor, Philip Hammond MP, has today delivered the Spring Statement, announcing that the economic outlook is better than previous estimates and launching two key consultations for the bioscience sector.

The Spring Statement is a lower-key affair than in previous years, when the Budget would be announced at this time of year; in 2016, the Chancellor decided that the government would only hold one major fiscal event each year, to be held in the Autumn. Each spring, the Chancellor’s speech will therefore respond to the forecast from the independent Office for Budget Responsibility (OBR) and announce consultations but shouldn’t include tax changes or spending decisions.

The economy is doing slightly better than expected

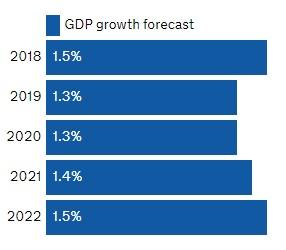

The economy has grown for five consecutive years, and exceeded expectations in 2017, the Chancellor said. The OBR has revised its GDP growth forecast up for 2018 from 1.4% to 1.5%.

Government borrowing has fallen by three-quarters since 2010. In 2009-10 the UK borrowed £1 in every £4 that was spent. The OBR expect that we will borrow £1 in every £18 this year. Debt will start falling as a share of GDP next year. There’s also good news for individuals: the OBR expects inflation to fall over the next 12 months, and wages to rise faster than prices over the next five years.

Spending Review

The Chancellor said there will be a full spending review in 2019, which will determine spending and investment across government, including the Research Councils and Innovate UK, up until and potentially beyond the next general election, which should be in 2022.

Consultations on Entrepreneur’s Relief and a new investment fund

Alongside the Chancellor’s speech, the Treasury has published a consultation on Entrepreneur’s Relief and another on establishing a new Enterprise Investment Scheme knowledge-intensive fund, both of which were first announced in response to last year’s Patient Capital Review. These will both be important for the bioscience sector.

Funding for R&D continues

Although the Spring Statement didn’t include any new funding announcements, the government is continuing to invest in R&D. Yesterday, £300 million was announced for the “Healthy Ageing Grand Challenge” of the Industrial Strategy Challenge Fund. £210 million of this will be invested in the development of innovative new diagnostic tools, medical products and treatments. Further funding will be investing in genomics, ensuring the UK continues to lead the world in this area. And over £70 million is going to be invested in creating regional centres across the UK to offer UK patients better diagnosis using new technologies including Artificial Intelligence (AI). Each centre will enable companies, including SMEs, to rapidly develop, test and implement products and systems in partnership with doctors and academics, improving patient care and gaining early evidence of real-world product value.

Expressions of interest are also now open for the Industrial Strategy Challenge Fund Wave 3, giving stakeholders the opportunity to suggest what further tranches of funding should be spent on.

What next?

The BIA’s Finance and Tax Advisory Committee will be responding to the consultations on Entrepreneur’s Relief and Inheritance Tax. It is also currently drafting a response to a government review of the Intangible Fixed Assets tax regime. For more information or to contribute, contact me.

The BIA will also begin planning for the Comprehensive Spending Review; as in previous years, we will work in partnership with colleagues across the life sciences sector, including charities and public research funders, to make the case for increased investment in science and innovation.

The UK continues to have a very favourable tax regime for innovative bioscience companies and our recent finance report shows the UK sector is going strong. This week’s announcements of investment, improved economic forecasts and improvements to the tax regimes will strengthen the business environment further.

.png)

.png)