This page provides an overview of the new National Security and Investment regime, what transactions it applies to, how it will work in practice and the penalties for not following it.

We will update this page as more information and resources become available. This content is based on the drafting of the legislation as of August 2021, and may be subject to change. This is for information purposes only, it is not intended to be legal advice, and should not be used as such.

Summary of the National Security and Investment regime

The National Security and Investment (NSI) regime is the UK Government’s new approach to scrutinising and intervening in business transactions, both foreign and domestic, where necessary to protect national security. It gives the Government the powers to screen investments and carry out national security assessments of certain transactions, before or after they take place.

The regime will come into force in the UK on 4 January 2022, and will apply to transactions that have taken place on or after 12 November 2020.

It establishes a mandatory requirement for investors, or other acquiring entities, proposing investments in a defined sensitive sector of the economy to notify the Department for Business, Energy and Industrial Strategy (BEIS) ahead of the transaction taking place.

It will be managed and carried out by the new Investment Security Unit within BEIS, with the scrutiny powers being conferred on the Secretary of State for BEIS.

Transactions this applies to

Mandatory notification is required ahead of transactions where an investor gains control in an entity, meaning the acquisition of more than 25%, 50% or 75% of shares or voting rights in an entity, or can stop or pass any form of resolution in an entity.

This applies to acquisitions in one of the 17 sensitive sectors of the economy as set out by the Government, which includes Synthetic Biology and Artificial Intelligence.

Impact on UK life sciences

The Government has identified Synthetic Biology as a sector which requires mandatory notification of transactions to assess the potential risk to national security. This definition is still in draft format, and the final definition is expected to be published in the coming months.

Activities within the Synthetic Biology sector which fall under this regime currently include, but are not limited to:

- Carrying out basic scientific research into synthetic biology.

- The development of synthetic biology.

- The formulation of synthetic biology to enable the degradation of materials.

- The provision of services that enable the activities listed above.

Despite the list of exemptions in the definition, it is the BIA’s view that the definition still has the potential to capture most companies in this sector, the vast majority of which have no implication on national security. By placing these additional burdens on a sector that is heavily reliant on foreign investment to carry out its pioneering work, it risks hindering investment to the UK life sciences industry.

Investment Security Unit

The Investment Security Unit (ISU) within BEIS is responsible for operating the NSI regime, identifying, addressing and mitigating national security risks to the UK when certain transactions take place. The Secretary of State for BEIS oversees the ISU and has the ultimate decision-making authority.

Ahead of the regime coming into force, investors can have informal discussions with the ISU to determine whether a transaction would fall within the scope of the regime. Businesses can also get advice on what to expect from the regime to assist in business planning by emailing [email protected]. Find out more about the Investment Security Unit here.

Mandatory vs. voluntary notifications

Acquisitions in the sensitive sectors of the economy that meet the control thresholds are subject to mandatory notification ahead of the transaction taking place. Such acquisitions must gain clearance from the ISU before proceeding, and if no notification is submitted, the transaction will be void. It is the responsibility of the acquirer to submit the notification.

Investors who are carrying out acquisitions in other sectors but fear their acquisition may be considered to have an impact on national security can make a voluntary notification to the ISU. This follows the same process, explained below. As the ISU has the power to investigate all investments in any sector which could impact national security up to five years after they take place, the voluntary notification system can be used to provide certainty that the transaction will not be investigated in the future.

Notification process

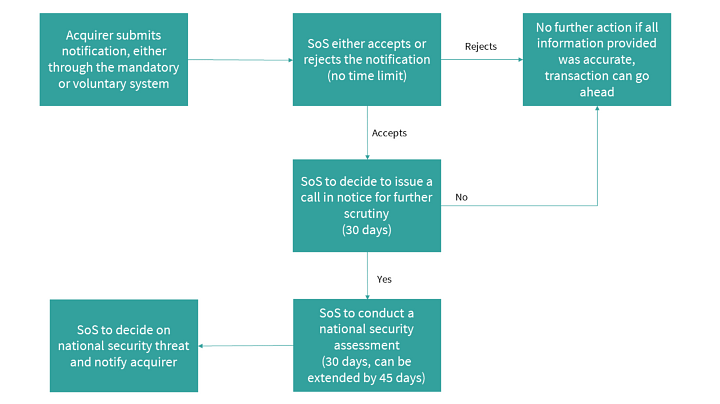

The investor must submit a notification if the transaction falls within the mandatory regime, or can submit a voluntary notification if it is outside this.

After the notification is submitted, the ISU must decide whether to accept the notification for further scrutiny, or reject it and allow the transaction to continue. There is no time restriction for this. Once the notification is accepted to pursue further, the ISU has a maximum of 30 days to decide whether to call-in the transaction for a national security assessment.

If the ISU doesn’t need to call-in the transaction, the investment can be pursued. If it is decided that there may be a national security concern, a national security assessment is carried out.

The ISU has up to 30 working days to complete this, but can extend this time by a further 45 working days and take any action it considers necessary and proportionate to address any national security risk. During this time, it can require businesses and investors to provide information relevant to the transaction. For voluntary notifications, businesses and investors can continue to progress the transaction during the assessment period, unless the ISU orders otherwise. Transactions subject to mandatory notification must not complete the transaction until clearance is given.

The ISU then decides whether the transaction can go ahead or not. This decision is final and cannot be revisited unless false or misleading information has been provided.

The Secretary of State also has the power to call-in investments in any sector that could give rise to national security concerns. This reserve call-in power can be used up to five years after the transaction takes place, so long as the Secretary of State takes action within six months of being made aware of the transaction. Being made aware of the transaction could be by reading about it in the newspaper, for example, or via voluntary notification.

Penalties

There are significant penalties for failure to comply with the regime. Transactions that take place without going through the mandatory notification system where required will be declared void. A company can be fined the higher of £10 million or up to 5% of worldwide turnover for completing a notifiable acquisition without clearance or for failing to comply with an order. Directors may also face up to five years in prison.

There is no penalty associated with not submitting voluntary notifications, unless orders are not complied with.

.png)

.png)