Guest Blog | Cell & Gene Therapy Catapult | Growth in UK Cell and Gene Therapy Industry Continues for Sixth Year Running

Dr Jacqueline Barry, Chief Clinical Officer, Cell and Gene Therapy Catapult

The Cell and Gene Therapy Catapult’s databases of UK clinical trial and preclinical activity reveals a surge in cell and gene therapy trials, highlighting the UK’s thriving ecosystem for developing cell and gene therapy products.

As we have done for the past six years, we have reviewed and updated the cell and gene therapy clinical trials and preclinical activity databases which provide a highly relevant measure of progress in our field. By comparing the data year on year, we can identify trends and growth areas across the industry within the UK, and I am happy to see that this year’s database has revealed some positive insights:

- Growth in the number of cell and gene therapy clinical trials and preclinical trials of 37% and 20% respectively

- An increase in the number of commercially-sponsored clinical trials which are now the majority, making up 66% of clinical trials

- A rise in the number of clinical trials that involve genetic modification, which now make up ~70% of clinical trials

It is fair to say that these factors combined demonstrate growth and confidence in our industry, which we would expect to continue well into 2019. Growth has been driven by increased investment from commercial sponsors as they become increasingly confident in the potential of cell and gene therapies, and in the UK as a place to develop and manufacture them.

There are several key takeaways from this year’s database, here are my top four:

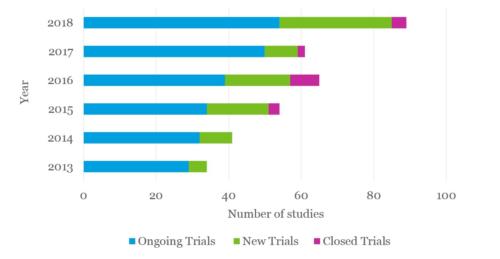

Growing portfolio of clinical trials

There are 85 cell and gene therapy clinical trials ongoing in the UK, an increase of 37% compared to 2017. Overall there has been a net increase in the number of new and ongoing trials compared to previous years, with a large amount of new trials and an increasing amount of gene therapy trials.

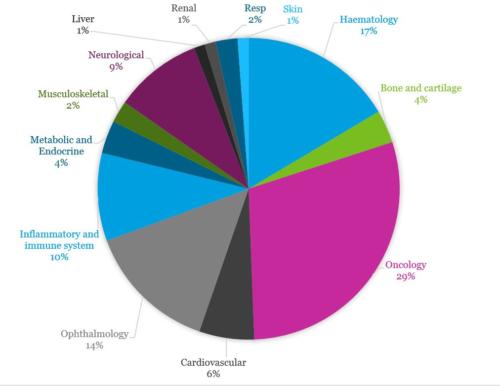

Oncology remains dominant therapeutic area

Oncology (including haematological malignancies and solid tumours) remains the dominant therapeutic area (29%) as reported in previous years. Haematology (16%) and ophthalmology (14%) also make up a large proportion of trials.

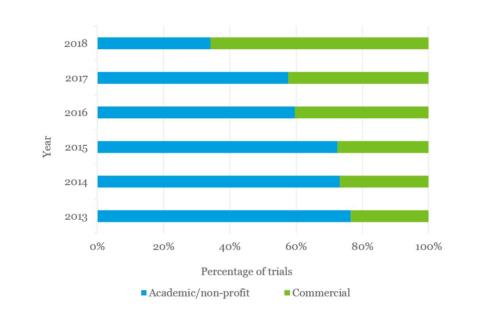

Increased commercial sponsorship

The number of commercially-sponsored clinical trials has increased in 2018, becoming the majority. This reflects the growing confidence in the cell and gene therapy industry attracting private companies and a significant increase in UK spinouts.

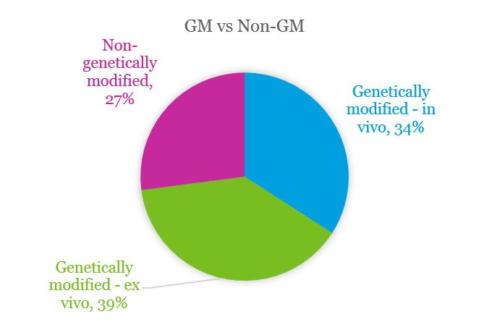

Majority of therapies are genetically modified

~70% of the clinical trials in the UK involve genetic modification (both in vivo and ex vivo). Analysis has also identified three trials using genome editing technologies, which demonstrates a significant step in the development of these technologies.

There are many reasons to be positive as we enter 2019; the excellent research from UK academia and the NHS, the growth of UK manufacturing capacity including the CGT Catapult manufacturing centre, the Advanced Therapy Treatment Centres to name a few, support our industry to continue to flourish.

The UK is attracting new and innovative companies and investment from the UK and round the world. To illustrate this point of the 85 clinical trials included in the database, 40 are sponsored by non-UK companies and of the 92 ongoing phase III trials recorded by the Alliance for Regenerative Medicine, 16% percent are taking place in the UK.

Let me leave you with some thoughts from Cell and Gene Therapy Catapult CEO, Keith Thompson, as he reflected on this year’s analysis…

“The UK is fast becoming the premier hub for advanced therapy research and development. We are building the world’s most complete advanced therapies ecosystem. As the number of clinical trials has accelerated, the UK has made a determined effort to scale-up its research and manufacturing infrastructure to ensure this rich pipeline can continue to advance and grow.”

.png)

.png)