Life science VC investments perform equally or better than other sectors, new data shows

A report published today by the British Business Bank is the most comprehensive analysis of UK life science venture capital performance to date, and it reveals that life science investments have performed equally or better than those in non-life sciences.

The BIA worked with the British Business Bank to compile the data because there is currently a lack of information on our sector’s financial performance in the public domain that investors can access to make informed investment decisions. The findings are positive and the dataset will become richer and more accurate as the cohort of venture funds mature. The findings also have implications for the policy work the BIA does, which we address in this blog and plan to discuss with our members and policy makers in the year ahead.

Background

The UK venture capital market is not as mature as the that of the US. There are fewer funds and those that we have are often of a smaller scale. This is at least in part because UK institutional investors do not see the industry in a good light, and a reason often put forward for this is the lack of data on the returns that have been made in the past (across all sectors). So, as part of its mission to ensure the proper functioning of the UK’s private capital markets, the British Business Bank last year committed to improving the quality and availability of UK industry-level returns data. They published their first analysis in Oct 2019, which compared UK and US returns, finding the UK to be “close” to that of the US. This analysis was not sector-specific.

During the production of the BIA’s recent guide to investing in the UK biotech sector, we struggled to find public information on the performance of UK VC funds investing in life sciences. The Association of Investment Companies ranked biotech and healthcare as the top performing sector over ten years, but this data reflects investments in both public and private companies. Cambridge Associates don’t publish UK-only biotech data for their VC performance metrics.

The BIA therefore worked with the BBB to encourage the VCs within our membership and network to provide their data confidentially to the BBB, so that they can analyse the pooled performance and publish the information.

The findings

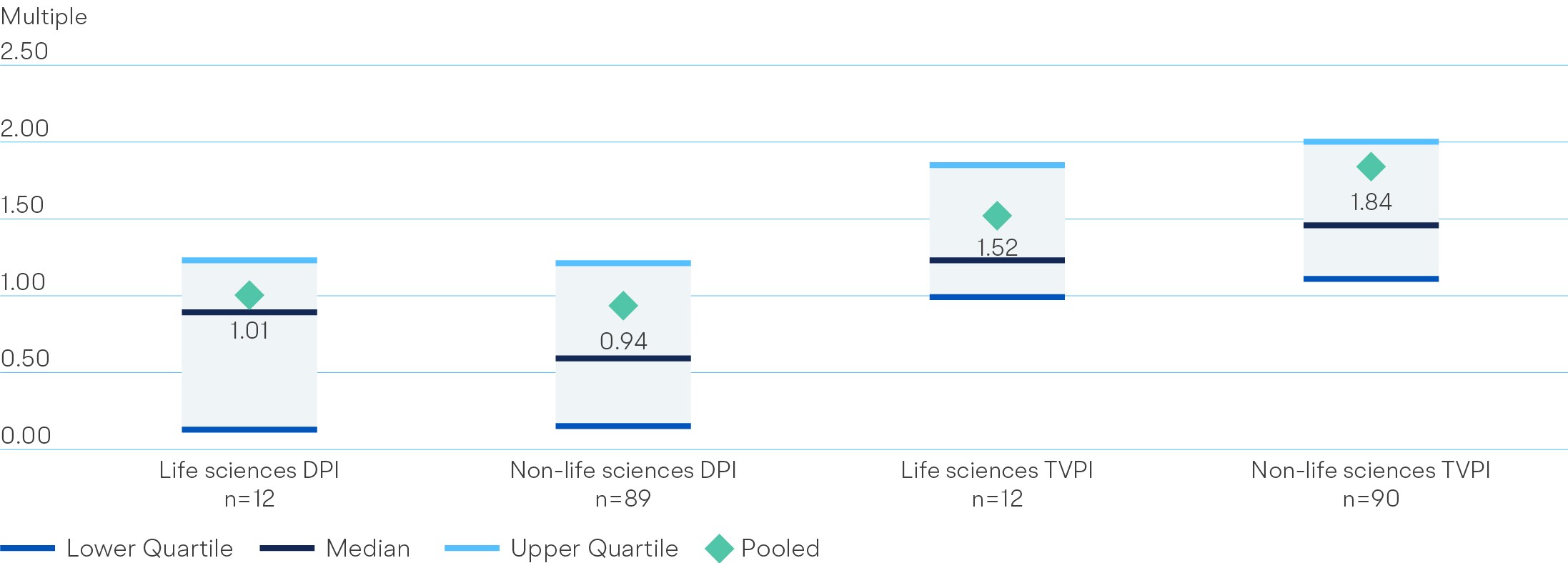

The analysis compares a cohort of 12 life science VC funds established between 2002-2015 with 89 non-life science funds founded during the same period.

Life science VC funds generated a pooled DPI multiple of 1.01, slightly ahead of non-life science funds of 0.94. DPI means Distribution to Paid-In capital, and represents realised fund returns as a multiple of the capital contributed. This directly measures the cash received from portfolio company exits and returned to investors. A DPI of 1.01 means the fund returned £1.01 for every £1 invested – not a great return as it stands, but it is important to remember that many of the funds in this cohort will be reasonably young (some only five years old) and won’t have exited all their investments, meaning the DPI will change (up or down) as time goes on. I.e. this is not the final performance of the fund, just its current state. The BBB’s analysis also found that 1.01 vs 0.94 is not statistically significant when controlling for other factors, so at this point we cannot categorically say that life science funds performed better.

Assuming a similar distribution of vintages between the two cohorts, the data also suggests that life sciences funds do not take longer to generate returns as DPI multiples are slightly ahead of other funds. Due to the long R&D timelines of biotech, it is often assumed that investors must wait longer to see the returns so this is an interesting finding. Life sciences is also assumed to be a riskier sector, but the spread of the upper and lower quartiles suggests this is not the case, and in fact the higher median return indicates it could be a less risky sector (at least at a fund level).

Another metric used in the report is Total Value to Paid-In capital (TVPI), which found that life science funds performed worse than non-life sciences (1.52 compared to 1.84). This is a measure based partly on estimated value of the portfolio companies, so is dependent on the VCs themselves valuing their companies. The BBB suggests this poorer performance could be due to life sciences VCs not marking up the value of their companies to the same extent that other sectors do, probably because in other sectors there are more indicators (for example tech companies can sell their product while developing it so you get an idea of market value), whereas life sciences is dependent on pivotal, binary clinical trials. This is a phenomena observed in America.

The analysis also separately looks at listed evergreen funds, which are another class of important venture capital investors but they operate in a different way to traditional VC funds. As such, their performance metrics aren’t directly comparable. Overall, the ten evergreen investors analysed have performed well as a cohort since 2015. The average net asset value per share increased 23% during this period, which is a 6% annualised increase. Syncona, a well known biotech investor in the cohort, compares well, with 48% growth over the same period.

The British Business Bank also surveyed fund managers for their views on market conditions. Most said that the UK VC market currently has a good number of quality investment opportunities available, and the majority of fund managers felt that the quality of investment opportunities had not worsened but was the same as those a year ago. However, fund managers had more mixed views on the market for exits for their portfolio companies and for raising new funds, reflecting the greater uncertainty in the economy.

Implications for the BIA’s policy work

Venture capital is the main source of funding for early-stage biotech companies. It accounted for just over half of all investment in UK biotech in 2019. Having a vibrant and high-performing VC market in the UK is therefore vital for the continuing success of our sector. US VCs have become increasingly active in the UK and are a valuable source of finance, but more local capital and expertise should provide a more sustainable footing in the long-term and could create a virtuous circle of entrepreneurism in the UK ecosystem. Furthermore, if greater numbers of UK institutional investors take stakes in UK VC funds, wealth creation will be on-shored and again help create that virtuous circle.

This dataset is a useful start in the process of building an evidence base for the performance of UK life sciences VC. As already mentioned, the funds in the cohort are not mature and we will need to wait to see the eventual returns they generate. The small number in the cohort is a problem so we need to encourage more to take part; and we need the life sciences VC community to put forward robust evidence of the value they create, so that the BIA and our members can champion them in our work to promote greater levels of investment.

The emergence of listed evergreen funds as high-performing, major players in the UK ecosystem also raises the question of whether traditional 10-year VC funds are the most appropriate way to nurture life science businesses. They may also offer access to high-growth biotech investment opportunities for new groups of investors, including the general public and large institutional investors, like pension funds. This will unlock greater sums of capital to fuel start-ups and scale-ups.

The UK has a long history of finding innovative ways to finance businesses, from investment trusts in the Victorian era to the Dementia Discovery Fund established in 2015. Innovation is changing the face of the life sciences, with data, AI and digital fundamentally changing the characteristics of drug discovery and healthcare delivery. As our sector rapidly changes, so too must the ways it is funded. We need to strive to create new investment vehicles that match the requirements of companies, investors and society. On Tuesday, the Chancellor committed to creating a long-term asset fund to encourage pension funds to contribute their capital to the UK’s economic recovery, which the BIA has also recently called for. This is a positive development that we'll be looking at closely.

Generating robust evidence on how our sector and our investors are performing is vital to that work. We’re grateful to the British Business Bank for producing this valuable analysis and look forward to continuing to work with them in future years to expand the dataset and increase its value further.

If you have any comments or questions about this work, please do email me, I’d love to hear from you.

.png)

.png)