Preparing for the Spending Review | Part 5: What the fast-tracked spending round means for biotech

In this fifth edition in our blog series on the 2019 Spending Review, BIA’s Policy and Public Affairs Manager Eric Johnsson looks at what the recently announced fast-tracked spending round means for our sector. The last blog in the series is available here.

Last week, the Treasury confirmed what policy wonks had suspected for some time – there won’t be a multi-year Spending Review this year, but instead a fast-tracked one-year Spending Round.

The purpose of this quick Spending Round is to allow government departments time to focus on Brexit, while at the same time giving them financial certainty by determining department day-to-day budgets for 2020-21. These day-to-day budgets, which are due to run out next year, are known in government circles as ‘resource spending’.

However, the Spending Round will not allocate what is referred to as ‘capital spending’, which is money that is spent on investment and things that will create growth in the future – including R&D funding. According to the Treasury, this type of spending is already set for 2020-21.

The Chancellor said that the Spending Round will conclude in September, giving the Treasury and departments a very short deadline. Under normal spending reviews, there would be a public consultation process, but due to the short deadline it’s unclear whether there will be such a process this time.

But what is the difference between spending reviews and spending rounds? And what does it mean for our sector that capital spending won’t be covered in the Spending Round?

Spending Review v Spending Round

Spending reviews allocate how much each government department can spend within a specific time period. These budgets are known as Departmental Expenditure Limits, or DELs for short. DELs are split into resource spending (RDEL) and capital spending (CDEL), which accounted for 36.4% and 5.6% respectively of total managed government spending in in 2017-18.

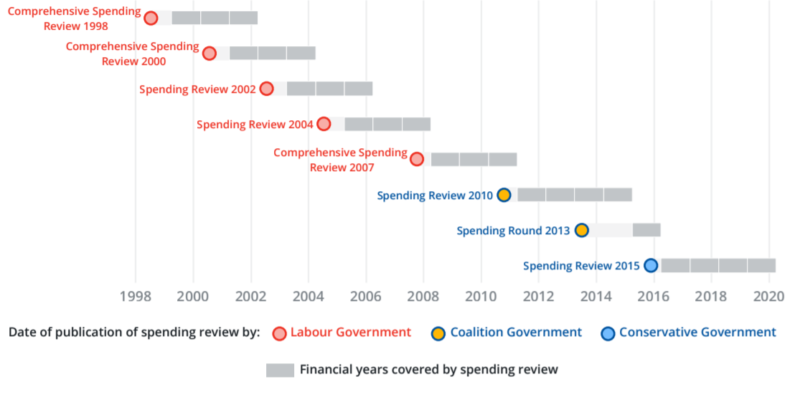

Most spending reviews set DELs for three or four years ahead, the exact intervals between the spending reviews and the periods for which they determine spending are decided by the Chancellor. The figure below by the Institute for Government shows the length and intervals of recent spending reviews/rounds.

Source: Institute for Government: The 2019 Spending Review - How to run it well (2018).

Spending rounds are essentially mini-spending reviews. As you can see in the figure, the Coalition Government conducted a spending round for one year only in 2013 as a compromise between the Conservatives and Liberal Democrats to extend DELs into the next Parliament after the 2015 General Election. But it’s worth pointing out that even though it was a short spending round, it still covered capital spending.

R&D funding under Boris

In a normal spending review which included capital spending, BIA would make the case for the increased government R&D investment in our sector. Indeed, a few months ago we published an interim report setting out how the sector is well positioned to leverage public R&D funding into further private R&D investment, highly paid jobs across the UK, economic growth and new innovate technologies for the good of the country. Our intention was to update the report in once the timelines for the Spending Review were announced.

But as capital spending (which includes R&D funding) won’t be covered in this year’s Spending Round and it is unlikely that there will be a public consultation process, the BIA has instead written to the Chancellor setting out the sector's priorities. You can read the letter here.

There is a slight caveat to the statement about R&D funding not being covered in this Spending Round: the UKRI budget allocations published in August 2018 didn’t include full 2020/21 budgets for the UKRI Councils, instead saying that they would be set at the next Spending Review. It is likely that the 2019/20 budgets will be rolled over, but we are trying to get clarity on this.

Despite capital spending not being included in the Spending Round, Boris’ government has gone on a spending splurge with several big announcements, including some positive news for our sector: £1.8 billion for the NHS, £250 million for a new AI lab, and a new fast-track visa route for scientists. These announcements – along with the Prime Minister’s remarks about the UK’s “extraordinary bioscience sector” in his first speech and the seemingly pro-science stance of his adviser Dominic Cummings – are good signs that our sector is high on the Government’s priority list. It also shows that there is plenty of scope for funding announcements outside a spending review – and there may be more to come.

It’s also worth mentioning that in his first speech as PM, Boris promised tax changes to increase incentives for businesses to invest in capital and research, hinting at the BIA’s long-called for expansions to R&D tax credits. This will not be part of the Spending Round either but could be included in a Budget in the autumn.

But while the Prime Minister seems open to an interventionalist approach to the UK economy (see this BIA blog by our Head of Policy, Martin Turner, on what Boris means for biotech), his Government has so far been quiet on industrial strategy and the previous Government’s target to increase R&D investment to 2.4% of GDP by 2027. This R&D target was central to the May Government’s overall industrial strategy and brought together broad policy areas such as public R&D funding, tax, education and international science collaboration under the same umbrella with a common aim.

There have been strong calls by the science community and the CBI for Boris to recommit the Conservatives to the R&D target, which the BIA will continue to support. Given the possibility of more funding announcements, we will also continue to emphasise the UK life sciences sector’s role in driving economic growth to the Prime Minister and his new Cabinet and make the case for the increased public investment in our sector, particularly around the refilling of the Biomedical Catalyst.

.png)

.png)