Innovative UK genomics companies are vital to the future wealth of our nation. With the right investment, skilled people and partnership working with the NHS family, UK SMEs are ideally placed to have an impact on the global stage.

Genomics nation 2022 report shows that UK genomics companies raised £1.9 billion of venture investment and £35.7 million in public grants since 2017, demonstrating the strength of this innovative sector.

The UK’s high-growth genomics sector:

- consists of 121 companies employing over 3,500 highly skilled people

- has a market cap of over £3.5 billion based on deals since 2017

- is young and growing, with half at early or seed stage

- has a higher proportion of spin-outs (34%) compared to other sectors (2.7%)

- relies on a range of skilled professionals, with 70% saying it was particularly difficult to recruit for computational and data science skills.

The report showcases the strengths and opportunities of this vibrant UK ecosystem of entrepreneurs, spin-outs and scale-ups.

“We welcome the latest Genomics Nation report from the BIA, Medicines Discovery Catapult (MDC) and Wellcome Sanger Institute which indicates that the UK’s genomics sector continues to go from strength to strength.

Clearly, the UK is leading the way in continuing to develop a rich genomic ecosystem which is growing across academia, healthcare and private companies. Genomics England draws on these talents and innovations to drive forward our programmes and partnerships with the NHS and other stakeholders.

We need to work together to develop more talent, close the skills gap, and strengthen our ecosystem. This will help us achieve our goals of improving patient outcomes and making the UK the best place in the world to do genomic research.”

- Baroness Nicola Blackwood, Chair of Genomics England.

For more information, please get in touch with Dr Emma Lawrence, Senior Policy and Public Affairs Manager, BIA.

Published in partnership with:

Forewords

This report lifts the lid on one of the most exciting sectors in the UK’s innovation economy in 2022: genomics. I want to thank our partners the Wellcome Sanger Institute and Medicine Discovery Catapult for collaborating on this report and all the genomics companies that give us the privilege to represent them.

As someone lucky enough to represent the sector to policymakers I’m often asked: what is the UK’s genomics industry? What do these companies actually do? How much are they worth? Why are you so excited about it? What do they need to grow? What’s the difference between epigenetics and pharmacogenomics? This report is our endeavor to answer these questions in an accessible format.

Genomics has long ceased to be simply a matter of academic interest. The NHS rare disease diagnosis odyssey has been transformed by this discipline, whilst the understanding of COVID-19 variants has delivered it to scale, public prominence, and its vital importance for public health.

Now the application and industrialisation of this technology is transforming both healthcare and the pharmaceutical industry, accelerating our understanding of diseases and how to tackle them.

That is why these innovative companies are so important to the wealth of our nation in the years ahead. With the right investment, skilled people and partnership working with the NHS family, UK genomics small and medium sized enterprises (SMEs) are ideally placed to be leading players in the most rapidly growing areas of biotech and life sciences.

In the last year we have witnessed some key developments for the UK genomics sector. Oxford Nanopore Technologies became London’s biggest biotech listing back in September 2021. Genomics England has launched three landmark programmes on diverse data, newborn sequencing and cancer. The Government published its Genome UK shared commitments earlier this year. These cross-nation commitments outlined ambitions to work closely with industry, encouraging partnerships and fostering an attractive environment for genomics SMEs. Now, GSK has put functional genomics at the heart of their R&D strategy for their new biopharma entity, after the demerging of their consumer healthcare business Haleon.

A new addition to this year’s report is our spotlight on the skills needs of this sector. Finding staff with the appropriate skills, particularly in computational and data science as well as artificial intelligence and machine learning is a growing challenge for these companies. Investing in the right talent pipelines will further nourish this fertile home of genomics, allowing companies to grow and thrive while boosting employment. Highlighting the opportunities to educators and students is vital and more engagement is needed to emphasise the well paid highly skilled jobs the genomics sector has to offer individuals pursuing a career in science.

The UK’s innovative genomics industry is thriving and will benefit both patients and the UK taxpayer as this innovative sector continues to grow. We have a rich ecosystem of spin-outs, scale-ups and SMEs which are continuing to develop and scale innovations that will improve our health and wellbeing not just in the UK but across the globe.

As genomics is the foundation of life, it should be the foundation of life sciences R&D. On this firm basis robust programmes with greater chances of success can be built, and build we must.

The UK leads the world in industrialising genomics research, and its use in healthcare. Its biobanks have also helped establish that linkage of a new drug target to a genomic feature, in real patients, doubles the success of medicines R&D. These are good headlines but hide the reality of the task ahead of us. Pioneering is not establishing. A high-tech industrial building is needed on this foundation to deliver functional genomics and proteomics, where most medicines matter.

Any build requires complex interactions between multiple trades, materials, and infrastructure. Our functional genomics build is no different. For it to succeed we need to deploy vibrant mixtures of skills, multidisciplinary collaborations, trusted patient engagement and a shared purpose. This is achievable with joint effort from public and private sectors — each playing to their strengths — and in vibrant, healthy ‘co-opetition.’

The application of genomics starts with consented patients, willing to give of themselves through their biosamples and data to help others. It is absolutely dependant upon patient and clinician trust, this is perhaps the greatest challenge. SMEs and pharma must work with the UK’s excellent Medical Research Charities and through deliberative citizen engagement as step one of many to make sure the UK’s health system can deliver its promise of being the world’s best environment for genomics-led discovery and development.

Skills and tools in Data Science will be critical to the success of this build — functional genomics is all about the data. However, these must be coupled to the application of new analytical technologies such as high throughout proteomics, digital biomarkers, and high content imaging to layer on valuable evidence for what occurs in the real world of active biology. Then new techniques in clinical experimentation and its regulation are needed to prove that what begins in a patient, proves true in a patient. These must all be industry-class and dependable if they are to be credible.

Multidisciplinary collaboration is essential. Functional genomics is a natural ‘team science’ activity which brings together clinical science, ‘wet’ and ‘dry’ lab technology, regulators, and the industry-class management of multiple public and private sector players.

These multi-partner, public/private collaborations are where Catapults excel because they are the natural, neutral, trusted hubs for innovation to be nurtured. There is plenty of evidence to demonstrate this, particularly through the pandemic, in high-capacity PCR testing, vaccines and ventilators.

The UK rightly continues to pioneer through academic endeavour in this sector, with expansion of polygenic risk scoring and Biobanks, alongside long-term cohort projects such as Our Future Health.

Now — behind this leading edge — it is starting to secure a post-genomic future for R&D by harnessing its biotech, healthcare, and academic communities. By establishing singular purpose and combining public with private sector assets it has the potential to build a wonder of the modern world on this foundation.

The UK has a distinguished heritage as a genomics pioneer. From Watson and Crick’s original work at Cambridge, to John Sulston’s vision to map the human genome, to Genomics England’s pioneering work in population health, and UK Biobank’s unique and internationally acclaimed datasets, it has been a prime mover in genomics.

Indeed, the UK has sustained its impact over the years, contributing critical leaps within the field that originated here, via the work of Shankar Balasubramanian and colleagues that made routine, accurate, low-cost sequencing of human genomes a reality.

For almost twenty years, the UK has led the world in the development of genomics technologies and methodologies. Today, we can say that genomic research has come of age with the DNA-based studies and insights beginning to profoundly change healthcare delivery across the world. At the Wellcome Sanger Institute, we are contributing to the genomics revolution, which requires a deep focus on forging new partnerships and building innovative pipelines to deliver the benefits of genomic research for all.

Through a combination of public and private investment, the UK has grown an impressive cohort of genomics SMEs. Europe’s largest genomics cluster is based at the Wellcome Genome Campus and many other innovative companies are distributed across the UK.

Our academic peers in major research hubs such as California and Boston continue to lead the way when it comes to commercialising research, but as this report shows, we are beginning to see successful scaling of UK genomics companies, supported by growing investor appetite. This report also highlights that more needs to be done in this space, addressing the sector-specific skills shortage through further investment into talent development and support with securing skilled workers from overseas.

In the near future, we will need to address the challenges posed by ever-increasing amounts of genomic data. If we are to realise its full potential integration, interoperability, legislation and protection will all need to be actively addressed. A multi-omic approach to healthcare bears huge promise, as we know that complex diseases are caused by a combination of genetic and environmental factors, and so the integration of clinical and multi-omic studies will be key to breaking new ground. Innovations across sequencing, computing hardware, disease modelling, artificial intelligence, machine learning and genome manipulation will create ever more opportunities to grow the UK’s position as a genomics powerhouse.

Having world-renowned academic institutions, a strong focus on entrepreneurship, exemplary genomics data infrastructure, increasing access to risk capital, and an exceptional National Health Service make the UK unique and an ideal destination for innovation and investment.

Key findings

The UK genomics sector:

- 121 high growth companies with over 3,500 employees

- £1.8bn venture investment raised since 2017

- £35.7m public R&D grants since 2017

- Top investors: University of Cambridge seed and enterprise funds

- Top spin out universities: Cambridge and Oxford

Genomics skills challenges:

- Computational and data science skills most difficult to recruit for

- Lack of cross-sector experience and knowledge identified

- Difficulties in recruiting European talent highlighted

The UK’s genomics sector

The UK is home to a vital ecosystem of genomics companies. Not only do these companies attract private investment and create a wealth of highly skilled jobs, they are also developing cutting-edge innovations that will transform our health and wellbeing.

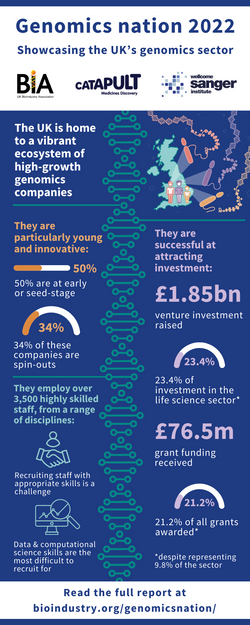

BIA, Medicines Discovery Catapult (MDC) and the Wellcome Sanger Institute have identified 142 genomics companies through two key criteria: they are headquartered in the UK and feature genomics as a core aspect of their business. As genomics is used throughout the life science sector, we refined our exclusion criteria this year, resulting in a smaller cohort. After identifying the 142 companies, we commissioned Beauhurst, a searchable database of the UK’s high-growth companies, to analyse the dataset. Of the 142 companies, Beauhurst identified 121 companies with active high-growth characterisitics (this excludes seven companies that are no longer operating, three that were not tracked and 11 that exited). The data presented in this section showcases this high-growth cohort during its lifetime.

- 142 genomics companies and 121 with active high growth

- 92% raised venture investment

- 61% large grant recipients

- 34% spinout companies

- 40% attended an accelerator

The 121 active high-growth genomics companies that populate the ecosystem have evidenced a unique capacity for innovation. Within this cohort of businesses, a remarkable number have originated from academic institutions. As of June 2022, 34% of the high-growth cohort are spinouts.

In comparison, spinout companies across all sectors accounted for just 2.7% in this same timeframe. The Universities of Cambridge and Oxford are the top universities for spinning out genomics companies with the Universities of Edinburgh and Birmingham following behind them. In support of the developing research in this area, 61% of the cohort have benefited from public funding. This is significant, as across the broader high-growth ecosystem (all sectors) just 9.4% of companies have been awarded grants.

As per last year’s cohort, these businesses are most likely to be experiencing very early-stage growth. In this group of companies there are 62, representing 51% of all active high-growth businesses, that are understood to be at seed-stage. For the wider high-growth ecosystem, the seed stage population is just 25.5%.

Published in partnership with:

Venture investment

Genomics companies are a highly investible sub-sector. Venture investments secured by UK genomics companies represented a disproportionately large amount of the total value of fundraisings secured by UK pharma and life sciences businesses.

Although genomics companies represent just 9.8% of the total population of the life sciences sector in Beauhurst’s dataset, from 2017 to 2021 they were able to attract 23.4% of all venture investment.

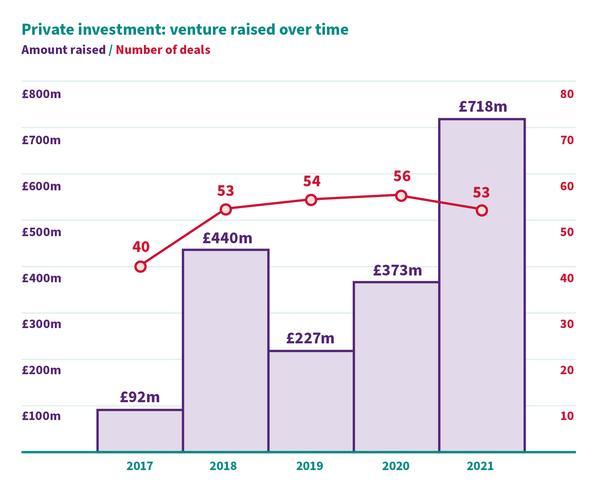

Between 2017 and 2021, genomics companies have raised a total £1.85 billion of venture investment — with 39.2% of this taking place in 2021 alone. In 2021, £718 million of venture investment was raised by genomic companies across 53 deals. This includes companies that exited during this time.

As illustrated in the previous chart, the value of venture raised by genomic companies has continued to grow over the last five years, increasing from £92 million to £718 million. Despite this exponential increase in the value of funding, the number of deals taking place have been relatively stagnant. This therefore indicates that genomic companies have benefited from higher-value venture investments in recent years, with markets recognising the importance of research and developments in the field.

For genomics companies, the average deal value for all venture investments in 2021 was £13.8 million. For comparison, the average for companies raising funding across the broader life sciences and pharmaceutical sector was distinctly lower, sitting at £8.4 million in 2021.

Public investment

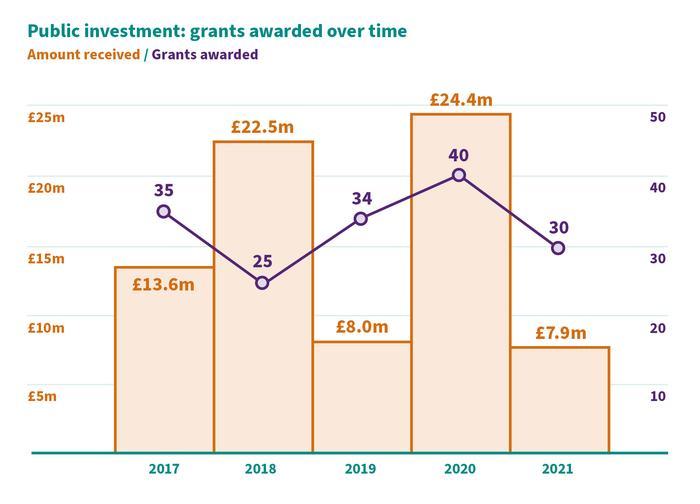

Genomics companies continue to secure a higher proportion of UK grant funding compared to the wider life sciences sector. From 2017 to 2021, genomics companies received £76.5 million of grant funding across 164 awards. This represents 21.1% of the £362 million grants awarded to life sciences and pharmaceutical companies within this time frame.

Similar to the trends observed for private investment, this indicates that genomic businesses hold a disproportionate amount of the funding received by the broader sector, given that they represent under 10% of the total life sciences and pharmaceutical industry.

In 2021, the average size of grants received by genomics companies was broadly similar to the average for all life sciences and pharmaceutical companies. However, across the whole five-year period analysed, there was a greater disparity between the two cohorts. For genomics businesses this figure stood at £501,000, whereas for life sciences and pharmaceutical companies this was lower at £321,000.

IPOs and acquisitions

Since 2017, eight genomics companies have exited Beauhurst’s high-growth database via either an acquisition or an IPO.

In this time frame, there were also three genomics companies that had undergone an IPO. The largest of these took place in September 2021, when Oxford Nanopore Technologies—a developer of portable DNA and RNA sequencing devices—floated with a market capitalisation of £3.4 billion. The company also raised £350 million in its IPO, representing the largest amount raised in a listing on the London Stock Exchange by a biotech company. The listing generated a great deal of interest, including from retail investors.

Amongst the five businesses that were acquired, only one of these deals was accompanied with a price. This transaction featured ATDBio, a business researching short DNA and RNA polymers, that was acquired by the Swedish consultancy service Biotage for £45 million.

Genomic hotspots

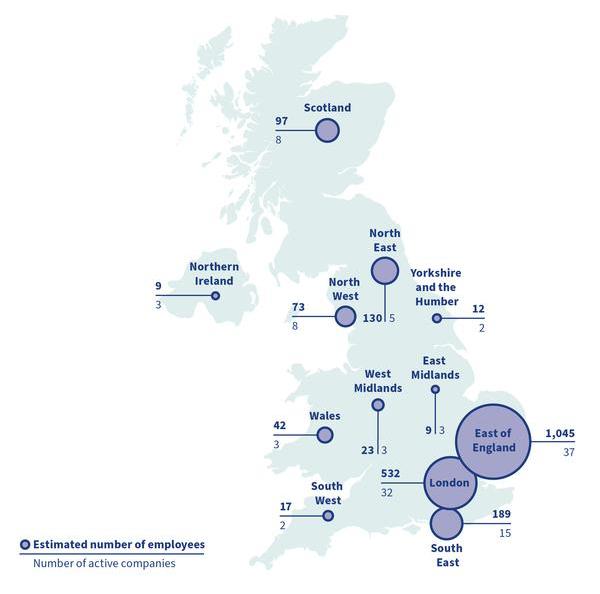

Genomics companies are most prevalent in the East of England, London and the South East, with these three regions accounting for 69% of the UK’s active genomics company population. However, there is a spread of genomics companies across the UK that have the potential to be expanded into vibrant genomics hubs. For example, there are eight genomics companies in Scotland and eight in the North West of England.

Spotlight on skills

Any growing sector needs access to a pool of specialised skills and talent to thrive. Genomics companies require a range of skills, from laboratory skills to data analysis and software engineering.

Genomics sits at the nexus of formerly unrelated disciplines, such as machine learning and biosample processing, posing a challenge to successful companies that need to recruit into niche specialisms as they scale up.

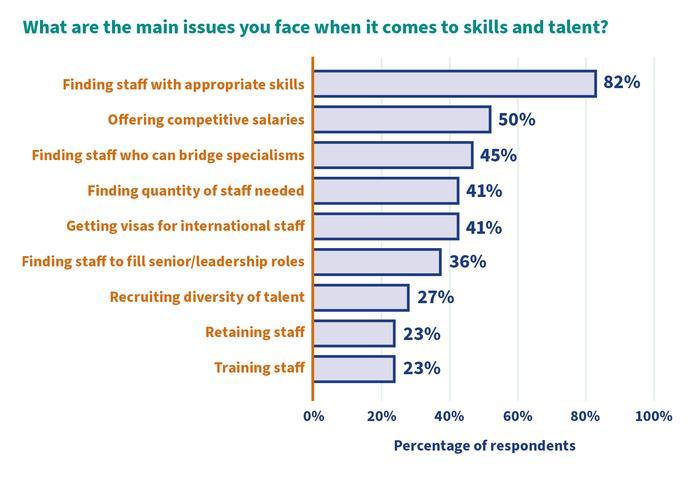

UK genomics SMEs were invited to complete a survey on skills to find out more about the opportunities and challenges they face (full methodology at the end). Finding staff with the appropriate skills was rated as the number one issue genomics companies faced when it came to skills and talent, with 82% of respondents citing this as a challenge. Second to this was the ability to offer competitive salaries, which 50% of respondents cited as a key issue. This suggests that the lack of suitable skills is causing competition in salaries being offered. More specific issues individual respondents raised included recruiting candidates with the right experience in the North East of England and finding candidates who would commit to balancing home and office working.

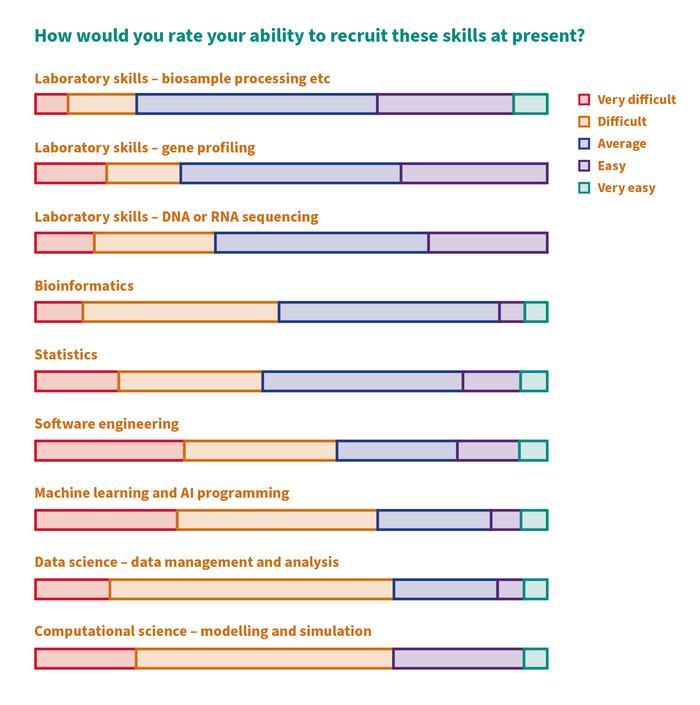

Computer science, data science and machine learning skills were seen as the most challenging to recruit for, with up to 70% of respondents who needed these skills saying it was difficult or very difficult to recruit such candidates. This highlights a shortage of computer and data scientists for the sector. With modelling, data analysis, and AI programming being key to the work of many genomics companies, this is an issue that needs to be addressed to facilitate the sector’s continued growth.

Furthermore, one respondent commented that desirable candidates should also have a broader understanding of the sector: “Finding staff from the software and data world with an appreciation of the challenges of working in healthcare and regulated healthcare [is a challenge].”

The high demand for these skills, with competition from the pharmaceutical, technology, and finance sectors, has led to competition in salaries. The nature of small but growing companies means they struggle to attract the same talent as the larger, more established sectors.

The future

The UK’s genomics heritage runs deep, from the solving of the DNA double helix structure in 1953 to the completion of the 100,000 Genomes Project in the 2010s. With recent investment continuing to fuel the genomics revolution, this trend of discovery and innovation looks set to continue.

The high-growth companies showcased in this report are a vital part of the genomics ecosystem. These businesses are young and proportionately more successful than their life science peers. Continued public and private investment in this area will cement the UK’s position as a leader in genomics. The technologies that these companies are working on will change our health and wellbeing, as well as improving our understanding of human biology.

While the UK remains a fertile home for genomics companies, this report has also shown that these companies struggle to recruit staff with the right skills at competitive salaries. With data and computational techniques being at the forefront of innovation, these companies rely on a pipeline of high-quality talent to develop their products and services. Investment in these skills within the UK, while also maintaining flows of international talent, will be vital in supporting this growing sector.

Finally, the strong genomics cluster evident in the South East of England represents a blueprint that can be replicated outside of this area. By investing in places, infrastructure, supporting spin-outs, and continuing the flow of public and private investment, the UK can become a network of vibrant genomics hubs that brings skills and employment across the length and breadth of this Genomics Nation.

Published in partnership with:

.png)

.png)