CEO Update - 19 May 2025

Now the language is about only committing to invest if there “is a pipeline of UK investment opportunities, which the Government has agreed to facilitate.” Private markets is now defined as “unlisted asset classes: equities, property, infrastructure and debt/credit” - no mention at all of innovation or sectors. The big win is the commitment for the “whole market, including intermediaries, to shift from cost to value."

So, the Accord on its own isn’t going to solve our capital challenge anytime soon. But there are plenty of opportunities to continue the momentum of the broader initiative - to get UK wealth to back UK innovation, to grow and to scale. The British Business Bank and its schemes will be crucial in the coming months, and the upcoming pensions bill will be a crucible to enable us to make the argument for allocation and mandation if capital isn’t flowing to UK growth opportunities. We have plenty of allies in this campaign, but last week was a missed opportunity by the UK investment community.

It’s why, for instance, last week we submitted our response to the House of Lords Science and Technology Committee inquiry on UK science and tech funding and scaling. Our message was clear: the UK has a scale-up capital gap in life sciences that must be addressed — and fast. We have a world-class innovation ecosystem, envied globally. But while international investors are alive to its value, UK capital remains largely absent. Instead, it's foreign investors who contribute the most, and far too much value is leaking abroad. Despite having the necessary capital and a political mandate to back Britain's future, UK pension funds aren’t seizing the opportunity to do this. If the City of London cannot voluntarily organise investment vehicles in 18 months to match the ambition of UK innovators and the UK government in backing our growth economy, they must, as I have previously said, be mandated to do so.

Seizing Europe's deep biotech potential

It was great last week to showcase our role as a partner in the European BioSolutions Coalition. At a key event in Brussels, Jane Wall, Managing Director at BIA, made the case that significant opportunity awaits if Europe can follow the UK’s innovative approach to regulation in Deep Biotech (highlighted by Isabelle Webb from DSIT) and can capture the interest of the investors and companies now looking outside the US for global leadership in science and technology, that is enabling biology-powered products and processes – so crucial for future global sustainability, a fully circular bioeconomy and net zero. You can read more about the BIA’s work in the space in our fully updated Deep Biotech report, containing updated UK stats and map, investment and case studies.

World Health Assembly

I’ll be keeping an eye on the WHO’s World Health Assembly meeting this week in Geneva. We expect to see the formal adoption of the Pandemic Treaty and will learn more about the WHO's plans as to how it will operate with the US withdrawing from the organisation, with its expertise and money. A new role for Jeremy Farrar in the leadership - and hopefully that means many of the things we hold dear will continue.

Celebrating our new annual supporters

Canary Wharf Group and Kadans Science Partner have become new annual supporters of the BIA. Canary Wharf is home to a fast-growing life sciences and healthcare cluster, with over 40 companies already based in the area, and together with Kadans, they are developing One North Quay – a major new life sciences hub in the heart of London. This purpose-built facility will offer labs, workspace, manufacturing capacity and community spaces for companies addressing some of the world’s most urgent health challenges. Kadans brings a pan-European network of researchers, innovators and entrepreneurs, and a strong commitment to creating the right environments for science to flourish. Their decision to back the BIA reflects the UK’s global leadership in life sciences and biotech – and their confidence in the sector’s potential to deliver both scientific breakthroughs and economic growth.

AviadoBio gives reason for optimism

In further positive news, it's great to see BIA member company AviadoBio begin recruiting for its ASPIRE-FTD clinical trial, testing a new gene therapy for frontotemporal dementia (FTD). The trial is now underway at Cambridge University Hospitals, with more sites to follow, and marks an important step in tackling this condition. It also highlights the UK’s growing leadership in advanced neurotherapies – combining scientific excellence, clinical infrastructure, and a drive to bring new treatments to patients faster.

Migration package - impact on our sector

The UK government unveiled a raft of migration policies to much media fanfare last week. We’ve been digging into what the Immigration white paper is likely to mean for our sector, and are seeking member feedback.

At first glance, increasing the amount of skilled international talent using very high talent routes, alongside faster routes for bringing talent to the UK, by making it simpler for top scientific talent to use the Global Talent visa route, is welcome. We also support a review of the Innovator Founder visa to ensure entrepreneurial talent from UK universities can start companies within the UK, and doubling the number of workers that overseas businesses can send to the UK should support building a UK presence.

However, raising the Skilled Worker RQF back to level 6 will affect the well-documented shortages of technical occupations (like manufacturing technicians), which should be included in shortage lists. The UK visa system is already amongst the most expensive. So, increasing the ISC by 32% will have an impact on the overall cost for talent to enter and stay within the UK, especially with family. We remain committed to working with partners to ensure we are developing the skills of home-grown talent from the UK to fill the roles our sector is creating from C-suite to shop floor, so it’s interesting to see how new proposals, like a £30 million fellowship from the Royal Society to woo scientists from the USA fits into this broader package of measures.

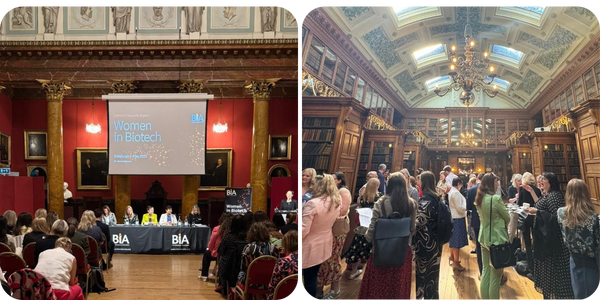

Reflections from Women in Biotech's trip to Scotland

Last week, we also celebrated Women in Biotech’s inaugural event in Scotland. Held in Edinburgh at the incredible Royal College of Physicians, it was a great occasion. A lively discussion about the next steps we should take from our Women in biotech leadership report, published in March, was one of the event highlights. At the event, Jane Wall, managing director of the BIA, outlined the findings of this report and the need to take further action going forward.