Looking back

Written by Melanie Senior, based on materials and reports provided by BIA and associates. Melanie is a biopharmaceutical science, strategy, investment and market access writer for Nature Biotechnology, Evaluate Pharma and IN VIVO.

On Friday, 10 March 2023 shockwaves from one of the largest and fastest bank runs in history reached UK shores. Biotech took the brunt, lurching from near-existential crisis to rescue in the space of a single weekend.

Even for a sector accustomed to risk, uncertainty, and volatility, this was a ride. After frantic calls with government officials and investors, nail-biting waits and, for some, brushes with insolvency, a relief package landed Monday, 13 March 2023 before breakfast.

A year later, we look back at what happened, and at how the UK BioIndustry Association (BIA) and its members helped avert what could have been a damaging blow to UK biotech.

Chaos in California

The trouble began as anxious customers of California-headquartered Silicon Valley Bank (SVB) began to withdraw tens of billions of dollars of deposits during the second week of March 2023. SVB, wracked by high interest rates and underperforming bond investments, had announced an emergency stock sale. Almost overnight, one of the tech and biotech sector’s most popular loan and deposit account providers went sour. Several other banks – Signature, First Republic and Credit Suisse - were spoilt in its wake.

SVB was placed into receivership on the morning of Friday, 10 March. That action, thousands of miles away, triggered one of UK biotech’s most hair-raising weekends.

Just before midnight UK time on Friday, the Bank of England (BoE) announced that SVB UK would be placed into insolvency. SVB UK, it declared, “has no critical functions” supporting the financial system and a “limited presence in the UK”. Eligible depositors would be paid out up to the £85,000 protected limit.

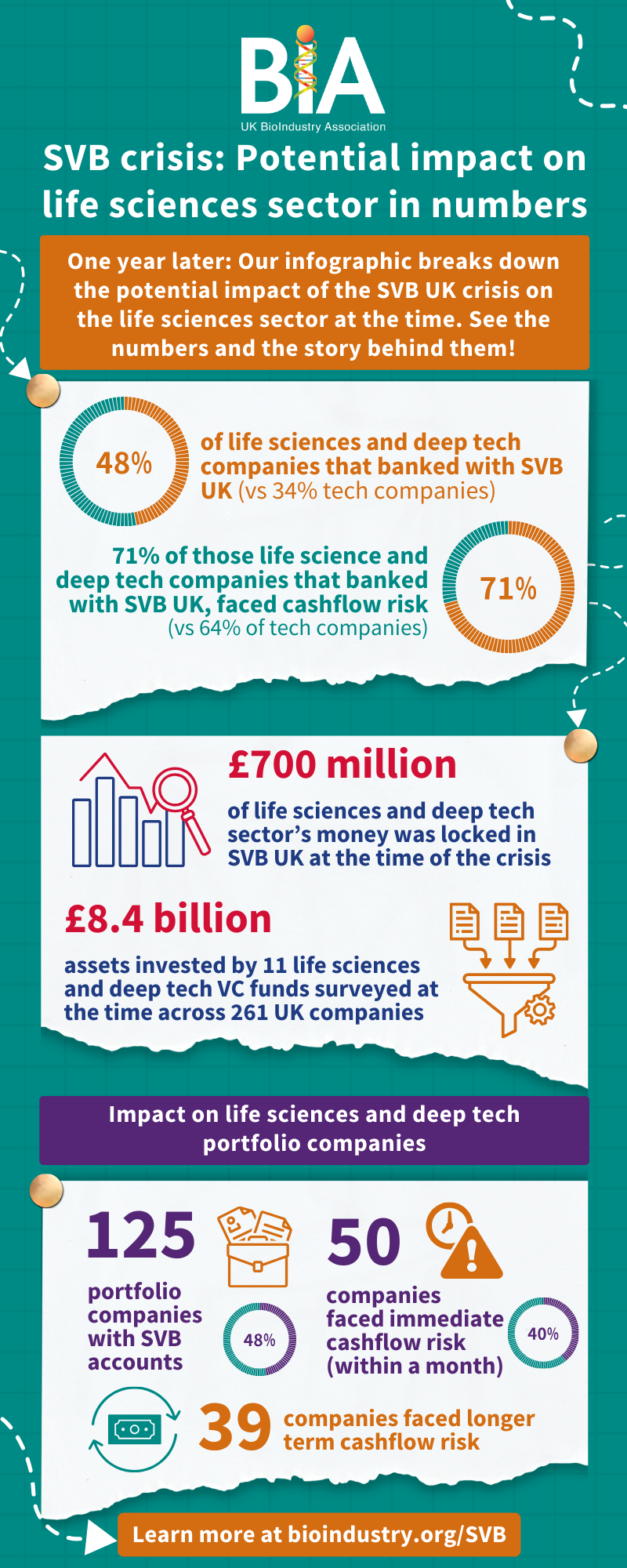

Few outside the sector understood UK biotech’s exposure. About half of all UK biotechs were SVB UK depositors. For many, it was their only bank. One biotech CFO reported holding over £50 million of cash or equivalents there. Overall, about £700 million of life sciences and deep tech money was locked into SVB UK, according to the British Venture Capital Association (BVCA).

Venture capitalists, biotech board members and advisors reported tears in C-suites, desperate insolvency planning and frustration at BoE’s apparent nonchalance.

We have a big problem

At 8.30 am on Saturday, 11 March, BIA’s CEO Steve Bates called the Treasury (HMT). Officials were told, in no uncertain terms, that this problem was big. Very big.

At least four biotech boards, compelled by Directorial duties, were discussing whether to cease trading on Monday. Employee payrolls were under threat. So was R&D: one biotech looked at cancelling a clinical trial contract to recoup cash.

With the term “existential threat” echoing in their ears, Steve Bates and BIA Board Chair Dan Mahony requested a follow-up statement from BoE. Companies needed reassurance that their money would not be lost.

Solution: Major UK bank steps in

The BIA team knew it needed a way forward. Dan Mahony had spent the morning calling for help from his contacts across the financial sector. Among the proposed solutions: selling SVB UK to a larger bank - a white knight that could step in to protect a key part of the UK’s future economy.

The rescue wheels were in motion.

Two hours later, a BIA tiger team is assembled and (then) Minister for Science, Research and Innovation George Freeman is pulled away from a Saturday funeral. Sir Jon Symonds, GlaxoSmithKline Chairman and former deputy group Chairman of HSBC Holdings, draws HSBC into the conversation. The bank reaches out to BIA.

It’s good news: they have a “highly experienced team” prepared to “move at pace”.

By Saturday lunchtime, the BIA executive board, leading VCs, the BVCA and the BIA’s own committee experts are drawing up an action plan. Its outlines: collecting evidence of UK biotech’s exposure to SVB’s collapse, offering solutions and keeping BIA members informed. At 1.45 pm, BIA reached out to 300+ CEOs and life sciences VCs for information to help HMT understand the extent of the problem - deposit amounts, cash burn rates, and access to other banking facilities.

Formal emails to the government followed that afternoon. The first lays out the extent of the problem. The second is a formal request for reassurance, clarity - and to execute the rescue plan.

The UK government must make clear SVB UK’s solvency status, particularly whether it has been successfully ringfenced from its US parent.

It should then consider BIA’s preferred option: a rapid, orderly sale to a UK bank committed to supporting innovation.

UK biotechs with full exposure to SVB UK must be supported with a new bank account facility by Monday morning.

By Saturday night, the storm-winds are subsiding. Granted, England’s rugby team had been eviscerated by the French in their worst-ever home defeat at Twickenham. But the BIA and its members and associates now has the Treasury’s attention: Andrew Griffiths, MP, sends Steve and Dan a suppertime email promising an all-nighter with representatives from across government. “There was probably a sense that we needed to recover our national pride,” recalls Dan.

A brighter Sunday

On Sunday morning, the chancellor, speaking on Sky News, mentions “tech and life sciences” during remarks about the SVB collapse.

At 8 am, a new Treasury statement materialises. The issue is “high priority”, and a solution to avoid or minimise damage to “some of our most promising UK companies” is being worked on “at pace”. Importantly, there are “immediate plans to ensure the short-term operational and cashflow needs of SVB UK’s customers are able to be met.”

BIA keeps its members informed throughout a nervous Sunday. Mediation fills the afternoon: BIA implores VCs not to take their money out in the event of an HSBC rescue. VCs reassure BIA. BIA reassures HBSC that buying SVB UK is, therefore, a good idea.

BIA gathers BVCA data to bolster the case. Nearly half the portfolio companies at surveyed VC funds had SVB accounts, and almost half of those faced a cashflow risk within four weeks. “Companies affected represent the best of UK technology. SVB invested alongside the strongest UK VC firms,” BVCA declared. Furthermore, since SVB is not heavily leveraged, “with support, the funds trapped in SVB can be unlocked,” the association said.

Sunday night – and into the wee hours - brings optimistic messages from HMT, Griffiths and HSBC.

On Monday morning at 6.44 am, the deal is “done”. Kate Bingham, managing partner at SV Health Investments and former Chair of the UK Vaccine Taskforce, posts the good news on X (formerly Twitter) before her 7.30 am spin class.

Dan recalls ‘palpable relief and joy’ (and the popping of at least one bottle of breakfast champagne) on a BIA team Zoom call.

UK biotechs have new HSBC accounts. Congratulations circulate: BIA to the government, public officials to BIA and its network for its role in solving the crisis. Dan Mahony and Sir Jon write to BoE governor Andrew Bailey and his team acknowledging the role of their “swift and decisive leadership” in averting long-lasting damage.

The solution achieved, they added, may even have placed the sector “in a stronger position than before.”

Lessons learned

Crises like these do not come around too often (we hope). When they do, they remind us why we collaborate for sector-wide representation, have a direct dial to HMT and the government powers-that-be, and engage in continuous outreach and education to nurture our industry and ensure it continues to thrive.

The investment and finance community pulled together that weekend to present a strong, single voice to the government. A lot of people worked very hard to rally colleagues and contacts across the sector. It worked.

We learnt a lot from the crisis. We hope that UK officials, the BoE and the Treasury did too.

If there is a moral to this story, it’s a familiar one: spread risk. Don’t put all your cash in one bank. And it pays to have an influential trade association!

Interested in joining BIA as a member?

Learn more about BIA membership and if you have any questions, please get in touch with:

Be the first to receive the latest updates on the UK biotech and life sciences industry including news from BIA, our members and industry partners.

.png)

.png)