The UK’s life sciences sector is at the forefront of innovation in bioscience and healthcare, and cell and gene therapies are among the most exciting areas of this innovation. These treatments sometimes referred to as advanced therapy medicinal products (ATMPs), involve using cells or genetic material to affect changes inside patients’ tissue, cells or DNA. Cell and gene therapies may offer longer-lasting effects than traditional medicines and have the potential to address complex diseases for which there are currently no effective treatments. These products have already been demonstrating their value for patients with leukaemia and lymphoma, and rare genetic conditions such as spinal muscular atrophy (SMA), and over the next decade, we expect to see more cell and gene therapies approved for a wide range of diseases.

This report provides an overview of the state of the cell and gene therapy sector in the UK and includes data provided by Citeline on the UK environment for financing and clinical trials. The data shows that investment into cell and gene therapy has observed a similar trend in the wider life sciences sector over the past five years, reaching historic highs in 2021 and then experiencing a significant decline since 2022. Despite this, UK companies have continued to attract significant venture capital (VC) funding, raising more than half of the venture capital funding secured by European cell and gene therapy companies in 2023.

The UK also continues to be the leading destination in Europe for clinical trials in cell and gene therapy, with 84 drugs in clinical development as of October 2023, ahead of France (45), Spain (44) and Germany (40).

The report also presents case studies on some of the BIA member companies driving innovation in this space:

- Autolus – a clinical-stage CAR-T cell therapy company which develops advanced autologous T cell therapies that have the potential to deliver life-changing benefits to cancer patients. Autolus is based in London and has a manufacturing site in Stevenage.

- Purespring Therapeutics – a London-based preclinical AAV gene therapy company focused on developing treatments for chronic renal diseases.

- Orchard Therapeutics – a global gene therapy company, headquartered in London, focused on discovering, developing and commercialising new treatments that tap into the curative potential of hematopoietic stem cell (HSC) gene therapy.

- Rinri Therapeutics – a near-clinical stage biotech company based in Sheffield that is pioneering the development of regenerative cell therapies for hearing loss.

These case studies help to provide a picture of how cell and gene therapy companies are driving transformative outcomes for patients, while also providing a significant contribution to the UK economy. They also highlight the key challenges facing UK companies in this space, including around scaling manufacturing processes, attracting and retaining talent, and navigating the access and reimbursement system. The BIA has been engaging closely with its members and key stakeholders in this space to help address these challenges, and this report provides an overview of how we are working to ensure that the UK remains a leader in cell and gene therapies.

In collaboration with

Rinri Therapeutics is a spin-out from the University of Sheffield, developing a first-in-class cell therapy for hearing loss, the most common sensory deficit in humans. Targeting sensorineural hearing loss; those patients with damage to specialised cells of the inner ear. The latest BIA's UK cell and gene therapy report, explores the usage of Rinri Therapeutics' hematopoietic regenerative cell therapies for hearing loss.

Orchard Therapeutics is a biotechnology company dedicated to bringing transformative gene therapies to patients with serious and life-threatening orphan diseases. The latest BIA's UK cell and gene therapy report explores the usage of Orchard Therapeutics' hematopoietic stem cell (HSC) gene therapy, as well as the challenges and opportunities of the innovation.

Purespring is revolutionising the treatment of kidney diseases with gene therapies that target a single kidney cell, the podocyte. The latest BIA's UK cell and gene therapy report explores the usage of Purespring's podocyte and the challenges and opportunities the company has had to navigate.

Autolus Therapeutics plc (Nasdaq: AUTL) is a clinical-stage biopharmaceutical company developing next-generation, programmed T-cell therapies for the treatment of cancer. The latest BIA's UK cell and gene therapy report explores the usage of Autolus' CAR-T cell therapy, and the challenges and opportunities the company has had to navigate.

Foreword

Steve Bates OBE, CEO, BIA

The UK has long been a leader in cell and gene therapy. These treatments are revolutionising our approach to healthcare by treating the root cause of the disease, including cancer and inherited genetic diseases. Over the past few years, we have seen the sector make significant strides in delivering transformative outcomes for patients with debilitating or life-shortening conditions.

UK-based companies are at the forefront of this revolution. Companies such as Autolus and Orchard Therapeutics, both spinouts from UCL, are pioneering the development and delivery of life-changing treatments. The transformative power of these companies was demonstrated when Orchard Therapeutics’ gene therapy treatment for the fatal disorder metachromatic leukodystrophy (MLD) was made available to newborns in the NHS.

The BIA has been a long-standing champion of these therapies and the companies developing them, engaging on issues ranging from manufacturing to patient access and adoption. Our expert Cell and Gene Therapy Advisory Committee (CGTAC) has worked with the UK Government and key stakeholders such as the Cell and Gene Therapy Catapult to support the development of the infrastructure, talent and regulation required to maintain the UK’s leadership.

The data and case studies presented in this report demonstrate the UK’s continued strength in the cell and gene therapy sector, with UK-based companies at the forefront of scientific developments and attracting significant investment. The report also highlights some of the challenges facing companies in this space, including ensuring sustainable patient access, attracting skilled talent, manufacturing at scale, and accessing sufficient capital. These challenges are faced by companies across the globe. However, if the UK is to maintain its position, then it is essential that all parts of the UK ecosystem continue to work together to address them.

The size of the UK cell and gene therapy sector means that it is both small enough to be intimately connected but big enough to have significant impact. Stakeholders across the sector – including industry, academia, government, NHS and patient groups – have already demonstrated an impressive ability to work collaboratively to address challenges and ensure the continued growth of the sector, including through initiatives such as the Advanced Therapy Treatment Centres and the Advanced Therapies Manufacturing Taskforce. It’s important that this momentum is maintained in order to unlock the full potential of the UK sector, and the BIA looks forward to playing its role as this exciting field continues to develop.

Big picture

Sven Kili, Chair of the BIA’s Cell and Gene Therapy Advisory Committee

The UK has long been recognised as a leader in cell and gene therapy, particularly as a source of research and innovation. The data presented in this report demonstrates shows that companies based in the UK here have attracted significant sums of investment over the past five years, and the UK is the leading destination in Europe for clinical trials in cell and gene therapy.

We are now seeing increasing numbers of treatments being made available, including in the UK, with the NHS now delivering these potentially life-saving therapies treatments to patients with blood cancer as well as some rare genetic diseases. Going forward, we expect to see more treatments made available for diseases with larger patient populations, with treatments in the pipeline for Alzheimer’s disease, Crohn’s disease and multiple sclerosis, amongst others.

The UK cell and gene therapy sector has demonstrated its ability to work collaboratively to respond to challenges, including through organisations like the BIA, which bring together key stakeholders in this space. I have had the privilege of chairing the BIA’s Cell and Gene Therapy Advisory Committee (CGTAC) for the past seven years, and over that time the committee has led a number of initiatives to promote the UK sector internationally and support efforts to develop the national ecosystem for cell and gene therapies. These have included close engagement with stakeholders on a number of issues, including supporting the translation of research, developing infrastructure for scaling manufacturing, helping to attract talent to the sector, and ensuring value-for-money patient access to these treatments.

There have also been several collaborative initiatives led by the Cell and Gene Therapy Catapult to support the continued growth of the sector. These collaborations have included the Advanced Therapy Treatment Centres (ATTC) Network to support NHS readiness for the adoption and use of cell and gene therapies. The Cell and Gene Therapy Catapult has also coordinated the Advanced Therapies Apprenticeship Community (ATAC), which has made significant progress in addressing the skills gap in the UK.

Going forward, the opportunities and challenges facing the cell and gene therapy sector will continue to evolve as more treatments are developed and launched for a greater range of diseases. Treatments for larger indications will present particular considerations for the sector, especially around manufacturing, logistics and reimbursement. Primarily, however, as more of these treatments are developed, the sector has an enormous opportunity to provide greater access to value-for-money treatments, thereby improving the lives of more patients. Over the next few years, it will be essential that stakeholders continue to collaborate closely to ensure that the UK remains a leader in this space and that NHS patients can benefit from these therapies.

State of the sector

The UK has played a major role in the research and development of cell and gene therapies, staking a claim as a leader in these treatments. This leadership is demonstrated by the number of companies based in the UK, the significant financing the UK-based companies have attracted over the past five years, and the high volume of clinical trials taking place in the UK. While the figures for both financing and clinical trials have slowed in recent years – mirroring trends seen across the life sciences sector – the UK continues to be the European leader for cell and gene therapy development.

Cell and gene therapy developers are defined as companies that have a pipeline that includes therapies based on modification of gene expression via administration of DNA or RNA; or administration of live whole cells or maturation of a specific cell population in a patient for the treatment of a disease. Data was collected on 31 October 2023.

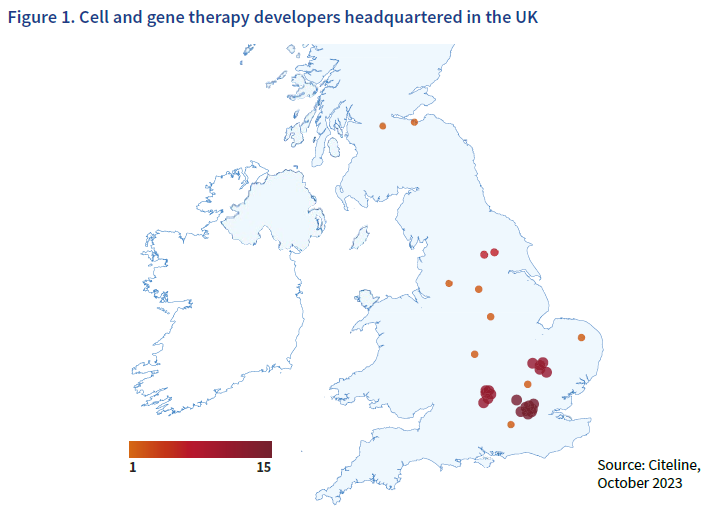

The data shows that cell and gene therapy developers are located across the UK, with hotpots in the Golden Triangle of London, Stevenage, Cambridge and Oxford. There are also a number of developers headquartered in cities across the north of the UK including in Edinburgh, Manchester, Sheffield and York.

The Cell and Gene Therapy Catapult’s 2023 manufacturing report shows that the manufacturing sites for cell and gene therapies are also spread across the UK, bringing jobs and investment to different regions.

Financing

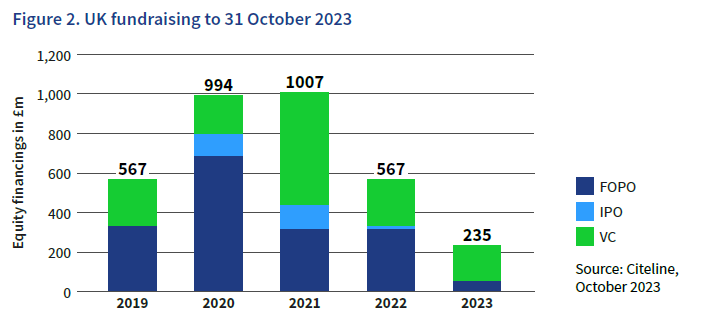

Over the past five years, there has been significant investment in UK companies to support the development of these treatments. The data shows that fundraising activity in the cell and gene therapy space has grown steadily among UK companies since 2019, but values have declined following their peak in 2021. This is a trend that has been observed in the global life sciences sector, so is not unique to cell and gene therapy, or the UK.

Throughout 2023, the market for Initial Public Offerings (IPOs) has been lacklustre across the globe, and UK cell and gene therapy companies have experienced the same trend. While follow-on financing is still viable in the space, there has been a considerable slowdown in 2023. However, VC funding has continued to flow into the sector in the past year, with a projected annual total of £245 million, only slightly lower than in 2022, which saw £314 million raised in VC funding.

In Europe, UK cell and gene companies raised more than half (55%) of the VC funding secured by European companies in 2023. Across all life sciences, the UK typically accounts for about a third of all European VC investment, so UK cell and gene therapy companies are particularly dominant. On a global scale, US companies raised 86% of cell and gene therapy venture funding in 2022 and are on track to outpace their international peers in 2023 as well.

The financing data includes all UK-based companies that are developing technologies which contribute to the development, delivery and manufacture of cell and gene therapies, in addition to therapeutic developers.

Clinical development

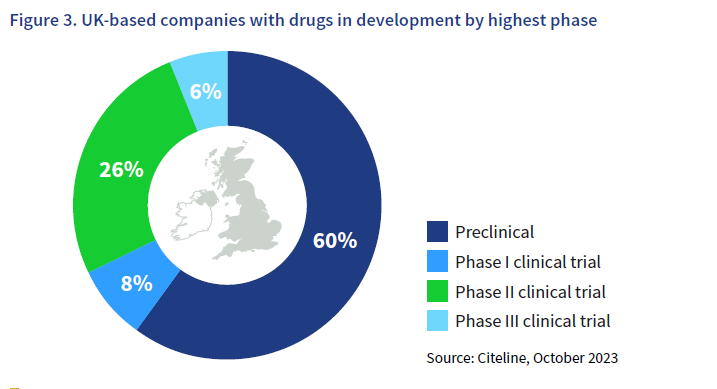

The UK cell and gene therapy sector has reached a state of maturity products spanning the stages of development, and some have reached commercialisation. Of those companies with drugs in clinical trials, four companies have reached Phase I, 12 have reached Phase II and three have reached Phase III.

Cell and gene therapy clinical trials are often structured as a Phase I/Phase II study where both safety and efficacy tests are performed on a small group of participants with the disease. These trials have been classified as Phase II in this data, and this is likely to account at least in part for the higher numbers of Phase II trials for cell and gene therapies than Phase I.

UK-based companies with drugs in development by highest phase

Approvals

There have been 23 cell and gene therapies approved for use in patients in the UK, with the potential for dozens of additional approvals in the next decade. So far, the UK has seen approvals across a wide range of therapeutic areas, including cancer, musculoskeletal diseases and eye disorders.

Companies driving cell and gene therapy

Autolus

Spun out of University College London, Autolus is a clinical stage, UK-based life science company which has developed extensive programming capabilities for autologous cell therapies that have the potential to deliver lifechanging benefits for patients. It is building an integrated next-generation CAR-T company for therapies across haematologic malignancies and solid tumors.

Learn more about Autolus

Purespring Therapeutics

Purespring Therapeutics is the first gene therapy company looking at the glomerulus in the kidney, which has thus far been under-examined as a target. The company is developing two programmes at present but also has a discovery engine to identify future opportunities. Crucially, Purespring is built as a long-term, highly integrated company that will be able to take treatments not just to the clinic, but to market.Learn more about Purespring

Orchard Therapeutics

Orchard Therapeutics is a global gene therapy leader focused on ending the devastation caused by genetic and other severe diseases by discovering, developing and commercialising new treatments that tap into the curative potential of hematopoietic stem cell gene therapy.

Learn more about Orchard Therapeutics

Rinri Therapeutics

Rinri Therapeutics is a biotechnology company based in Sheffield that is pioneering the development of regenerative cell therapies for hearing loss. The company’s innovative approach involves utilising auditory progenitor cells to replace the damaged auditory sensory cells in the inner ear, the primary structures responsible for converting sound waves into electrical signals that the brain can interpret.

Learn more about Rinri Therapeutics

Opportunities and challenges

Both the data and the case studies presented in this report demonstrate that the UK ecosystem has significant strengths that attract investment and support the growth of the sector. These strengths include the world-leading science coming out of UK academic institutions and well-developed scientific clusters that attract international talent and innovation. The UK funding environment also presents advantages for companies, with significant levels of public investment and grant support, including through Innovate UK. Additionally, the UK has a growing private investor base, with London-based venture capital funds such as Syncona and 4BIO providing substantial private investment into UK cell and gene therapy companies.

The UK’s attractiveness as a location for clinical trials has been driven by the opportunities for collaboration with the NHS and the role of the MHRA as a world-leading regulator. However, in the past few years, the UK has seen a decline in commercial clinical trial activity across the life sciences sector. Research from the ABPI showed that there was a 44% decline in the number of patients enrolled onto commercially led studies supported by the NIHR between 2017/18 to 2021/22. In order to address this decline, the Government commissioned Lord James O’Shaughnessy to conduct a review into the UK commercial clinical trials landscape. During the review, Lord O’Shaughnessy consulted with industry, including the BIA, with a high degree of consensus on action needed to increase the UK’s competitiveness. The review sets out 27 recommendations, including both priority actions to progress in 2023 and longer-term ambitions for UK commercial clinical trials. The recommendations seek to improve workforce and patient engagement, set-up times, approvals processes, and data access. These recommendations were welcomed by the Government, which has committed £121 million to support their implementation.

Other challenges facing the UK cell and gene therapy sector include navigating the patient access and reimbursement system, recruiting and retaining skilled talent, manufacturing at scale, and enabling sufficient access to capital. These challenges are not unique to the UK and the BIA has been engaged in a number of initiatives to address these challenges, as detailed in the next section.

Our impact

The BIA has been at the heart of the UK cell and gene therapy sector for many years through its expert Cell and Gene Therapy Advisory Committee (CGTAC), which has supported the development of this report. The committee brings together a large proportion of the UK’s industry, with over 20 UK companies, including biotechs, pharma, service providers and law firms, as well as key organisations including the Cell and Gene Therapy Catapult and Innovate UK as members.

The BIA works closely with stakeholders across the UK cell and gene therapy ecosystem to help promote and support the UK cell and gene therapy sector, including through our engagement in the following areas:

Cell and gene therapies face particular challenges within the evaluation and reimbursement system owing to their high up-front cost and uncertainty with regard to long-term outcomes. In order to address these challenges, the BIA works closely with key stakeholders, including NHS England and NICE, to ensure sustainable patient access to these transformative treatments.

One area of particular focus for the BIA has been enabling alternative approaches to reimbursement for cell and gene therapies which would ensure timely patient access to treatments while balancing risks and benefits between the NHS and industry. These alternative approaches, known as innovative payment models, would enable payments for cell and gene therapies to be spread over a period of time, and potentially linked to observed patient outcomes (sometimes described as “pay-by-performance” or “outcomebased” payment models).

In 2021, the BIA published a report making the case for the UK to enable innovative payment models for cell and gene therapies to ensure sustainable patient access to these transformative treatments. The report was informed by conversations with stakeholders across industry and patient groups and called for action to develop a route to patient access that effectively balances affordability with incentivising R&D investment for new therapies. In November 2023, the UK Government committed to conduct “two new innovative payment model pilots to support access to ATMPs” as part of the 2024 Voluntary Scheme for Branded Medicines Pricing, Access, and Growth (VPAG). The BIA looks forward to engaging with these pilots as plans progress.

The level of employment in the UK cell and gene therapy sector has grown significantly in recent years, with the Cell and Gene Therapy Catapult’s latest Skills Demand Report identifying over 6,232 roles in 2023, approximately double the number in 2019. The report found that companies are expecting overall employment to grow by 63% over the next five years, reaching over 10,000 by 2028.

In order to ensure that the continued growth of the sector is not restricted by the availability of a skilled workforce, the cell and gene therapy sector has developed a number of initiatives to support training and outreach. The BIA has supported a number of these initiatives, including the Advanced Therapy Apprenticeship Community (ATAC), which is coordinated by the Cell and Gene Therapy Catapult. The programme supports over 280 apprentices from 50 organisations to train and upskill individuals in developing, manufacturing and delivering advanced therapies.

To help attract more people to work in cell and gene therapy, the BIA has developed a series of videos showcasing the variety of roles and career paths within the sector. The videos were developed with support from LifeArc and filmed at the Cell and Gene Therapy Catapult’s skills training labs in Stevenage. In the videos, participants talk about their motivations for working in the sector and share their advice for those who are starting out.

As the sector evolves, the skills that it needs to attract have developed, and there are now an increasing number of biotech roles requiring digital and data-driven skills. In order to support the sector in recruiting people with these skillsets, the BIA has launched the #BIGIMPACT campaign. #BIGIMPACT aims to inspire graduates and seasoned professionals with digital and data-driven skills to pursue a career in the biotech industry. The campaign website bigimpact.org.uk serves as an information hub, for individuals interested in biotech careers. It provides valuable insights into the diverse career opportunities within the sector, including insight into roles such as AI engineers, bioinformaticians and data analysts. The website also showcases some of the most innovative and impactful companies operating in biotech.

The BIA has engaged closely on initiatives to support the growth of the UK medicines manufacturing sector, including for cell and gene therapies, and significant progress has been made in recent years.

The BIA is part of the Medicines Manufacturing Industry Partnership (MMIP), alongside the ABPI, Innovate UK and the Office for Life Sciences (OLS). The MMIP was established in 2014 by the UK government and the biopharmaceutical industry. The partnership aims to ensure the UK’s position as a global leader in innovative advanced medicines manufacturing.

In 2016, the MMIP formed the Advanced Therapies Manufacturing Taskforce (ATMT) to define the conditions necessary to “anchor” commercial-scale manufacturing of ATMPs in the UK. The ATMT put forward a set of recommendations which were accepted in full in the 2017 Life Sciences Industrial Strategy.

Since then, significant progress has been made in the delivery of the ATMT’s recommendations, including substantial investment into advanced therapies manufacturing. This has supported the rapid growth of UK’s ATMP GMP manufacturing space, with the Cell and Gene Therapy Catapult reporting an increase from 2,200 sqm in 2017 to 52,733 sqm in 2023. The BIA is looking forward to supporting the continued growth of the sector and welcomed the UK Government’s recent announcement of £520 million investment in life sciences manufacturing between 2025 and 2030.

The data in this report shows that the UK leads Europe for cell and gene therapy financings but stands far behind the US. This is not a challenge unique to the cell and gene therapy sector – it’s widely acknowledged that UK life sciences companies are underfunded compared to their US competitors – and the BIA is committed to improving access to finance across the ecosystem.

There have been a number of areas of progress in the past year. In July 2023, the UK Chancellor and Lord Mayor of London announced the Mansion House Compact, which committed nine pension funds to allocate 5% of their assets under management to unlisted companies by 2030, potentially unlocking £75 billion scaling innovative companies. The Compact was a watershed moment in the BIA’s campaign to unlock UK-based institutional capital for investment into UK life science companies.

The BIA has also engaged in other policy initiatives which complement the commitment made in the Compact, including matchedequity funding from the British Business Bank and pension regulatory and reporting rule changes to enable and encourage greater investment from pension funds.

The tax environment is another key factor impacting investment into scaling cell and gene therapy companies. Earlier this year, the BIA conducted a campaign to ensure policymakers understood the importance of R&D tax credits for our sector, following the announcement of a planned cut to R&D tax credits in November 2022. Following the BIA campaign, the Chancellor announced an enhanced tax relief rate for “R&D intensive SMEs” at the Spring Budget in March 2023, providing essential support for scaling UK life science companies.

The BIA is now working with the government, UK life science venture funds and our members to ensure the capital unlocked by all these initiatives is deployed effectively into the sector, including cell and gene therapy companies.

Conclusion

The UK cell and gene therapy sector has already demonstrated its capacity to deliver transformative health outcomes for patients while bringing investment to the UK economy. The UK has established itself as a global leader in this field and through continued collaboration we can expect to see further growth in the coming years.

As the data and case studies in this report shows, the sector has progressed rapidly in recent years, with treatments being developed and approved for more and more diseases.

So far, the treatments that have been approved have been for relatively small patient populations, including rare cancers and genetic diseases. However, over the next decade, we are likely to see treatments developed for more common diseases, potentially including Alzheimer’s, Crohn’s disease, and multiple sclerosis. Treating diseases with larger patient populations will present new challenges for the sector, including around scaling manufacturing and managing affordability.

However, it will also provide enormous opportunities for the sector to grow and for more patients to be able to benefit from these transformative treatments.

This report has also shown how the sector has worked collaboratively to overcome potential hurdles, including on issues such as addressing the skills gap and building manufacturing capacity. The BIA has been closely involved in a number of initiatives to support the continued growth of the sector, and we continue to work closely with our community of members to ensure the UK remains at the forefront of this growing field.

.png)

.png)